Program Overview

Exceptional individuals at the largest institutional asset owners across multiple continents

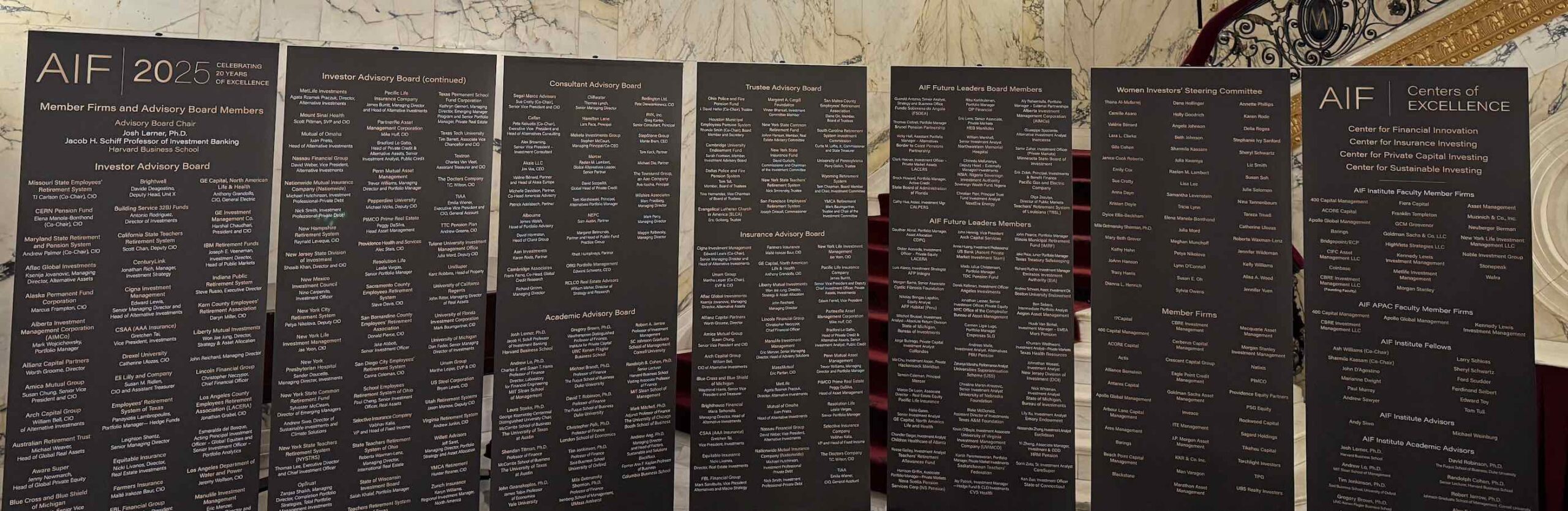

In 2023, AIF launched an initiative that was recommended by its Boards: the AIF Future Leaders (AIFFL) Program.

Since that launch, AIF has identified exceptional individuals at the largest institutional asset owners across geographies (six continents are represented in the AIFFL membership), investor types and demographics to participate in the AIFFL Program as Future Leaders.

The aim of the AIFFL Program is to integrate the Future Leaders into the AIF Global asset-owner community and provide them with tools and resources to support their growth as investment team leaders.

The main components of the AIFFL Program are as follows:

Participation in a research series led by world-class finance academics that provides Future Leaders with practical, actionable investment information

Participation in a Leadership Insights series featuring current and former CIOs and senior investment officers that draws upon their real world experience with boards, legislators, beneficiaries, and other stakeholders in the investment process

Engagement with other Future Leaders globally through the searchable AIFFL Member Directory about topics of mutual interest

Access to the AIF Investor Portal, which includes investment content, research, and academic and investor session recordings

The opportunity to rotate on to the AIF Investor Board of CIOs and senior asset owners based upon level of responsibility assumed and seniority reached

The ability to attend AIFFL Board and membership meetings

The opportunity to participate in all AIF forums, symposia and similar activities

Membership in the AIFFL Program will be redetermined by AIF annually.

AIFFL Board Members

Guerold Antonio

Senior Analyst at the Strategy and Business Office

Fundo Soberano de Angola (FSDEA)

Sovereign Wealth Fund

Angola

Michael Browning

Investment Officer

School Employees Retirement System of Ohio

Public Pension

United States

Jacob Caldwell

Director of Investments

Blue Cross-Blue Shield of AZ

Insurance

United States

Thomas Cottrell

Portfolio Manager

Brunel Pension Partnership

Public Pension

United Kingdom

Clark Hoover

Investment Officer – Private Market Assets

LACERS

Public Pension

United States

Brock Howard

Senior Portfolio Manager, Active Credit

State Board of Administration of Florida

Public Pension

United States

Cathy Hua

Associate Investment Manager

CALPERS

Public Pension

United States

Riku Karkkulainen

Portfolio Manager

OP Financial

Insurance/Private Pension/OCIO

Finland

Eric Lees

Investment Officer

United Nations Joint Staff Pension Fund (UNJSPF)

Private Pension

United States

William Marshall

Investment Manager

Northwestern Memorial Hospital

Endowment

United States

Andrew Mastroe

Senior Director, Investments Generalist

Children’s Hospital of Philadelphia

Endowment

United States

Chinedu Mofunanya

Head of Externally Managed Investments

NSIA: Nigeria Sovereign Investment Authority

Sovereign Wealth Fund

Nigeria

Christian Pieri

Manager

NextEra Energy

Private Pension / Nuclear Decommissioning Trust / Insurance

United States

Aly Rahemtulla

Director, External Partnerships

Alberta Investment Management Corporation (AIMCo)

Public Pension

Canada

Jake Price

Portfolio Manager

Texas Treasury Safekeeping

Endowment

United States

Simon Proulx

Senior Associate, External Portfolio Management

CPP Investments | Investissements RPC

Public Pension

Canada

Alex Ramos

Senior Investment Officer

State Universities Retirement System

Public Pension

United States

Tyler Rico

Associate Portfolio Manager – Private Equity

California State Teachers’ Retirement System (CALSTRS)

Public Pension

United States

Sean Sarraf

Portfolio Manager, Private Markets & Head of Private Credit

Pennsylvania Public School Employees’ Retirement System (PSERS)

Public Pension

United States

Neon Shariful

Investments – Private Markets

Hostplus

Superannuation

Australia

Giuseppe Spaziante

Alternative Investment Analyst

Inarcassa

Private Pension

Italy

Samir Zahar

Investment Officer (Private Markets)

Minnesota State Board of Investment

Public Pension

United States

Erik Zidek

Principal, Investments & Benefit Finance

Pacific Gas and Electric Company

Private Pension / Nuclear Decommissioning Trust

United States

Olga Zozulya

Director of Public Markets

Teachers’ Retirement System of Louisiana (TRSL)

Public Pension

United States

AIFFL Members

Gauthier Abrial

Portfolio Manager, Asset Allocation

CDPQ

Public Pension

Canada

Didier Acevedo

Senior Investment Manager, Private Equity

LACERA

Public Pension

United States

Luis Alarco

Investment Strategist – Bottom Up

AFP Integra

Private Pension

Peru

Daniel Amiri

Investment Director – Alternatives

Northwestern Mutual

Insurance

United States

Scott Anderson

Investment Manager, Pension Fund Management Team

Environment Agency Pension Fund

Government Agency

United Kingdom

Lyes Arezki

Portfolio Manager

UMR Retraite

Private Pension

France

Roger Arrieux

Investment Analyst

Building Service 32BJ Benefit Funds

Private Pension

United States

Javier Marcos Arroyo

Alternative Investments

VidaCaixa

Insurance

Spain

Rob Balderrama

Senior Analyst, Private Equity

MacArthur Foundation

Foundation

United States

Morgan Barna

Investment Associate

Cystic Fibrosis Foundation

Foundation

United States

Chase Barnes

Investment Officer for Private Markets

Kansas Public Employees Retirement System

Public Pension

United States

Erik Berglund

Portfolio Manager

Alecta

Private Pension

Sweden

André Berto Gimenez

Department of Investment in Funds and Equity

Finep

Foundation

Brazil

Nathaniel Boone

Lead Investment Analyst

DC Retirement Board

Public Pension

United States

Shaun Braswell

Investment Analyst – Private Equity

North Carolina Department of State Treasurer

Public Pension

United States

Nikolay Bringas Lapshin

Senior Equity Analyst

AFP Habitat (Peru)

Private Pension

Peru

Mitchell Brussel

Investment Analyst – Absolute Return Division

State of Michigan, Bureau of Investments

Public Pension

United States

Jorge Buitrago

Private Capital Investment Specialist

Colfondos

Private Pension

Colombia

Brandon Callison

Senior Investment Analyst

William Blair & Company

Private Wealth

United States

Jason Campbell

Associate Portfolio Manager, Absolute Return

CN Investment Division (CNID)

Private Pension

Canada

Camilo Franco Cancelado

Private Markets Specialist

PROTECCIÓN S.A

Private Pension

Colombia

Kevin Cao

Associate Portfolio Manager

San Francisco Employees’ Retirement System

Public Pension

United States

Tom Carlin

Vice President, Investment Analyst

Wells Fargo & Co

Private Wealth

United States

Hugh Carrow

Investment Manager

West Yorkshire Pension Fund

Public Pension

United Kingdom

Francesco U. Castellani Tarabini

Co-Portfolio Manager, Private Debt Investments

Generali Investments

Insurance

Italy

Siddhartha Chabria

Manager

LIC Pension Fund

Public Pension

India

Jean-Michel Charette

Director, Investments & Portfolio Management

HEC Montréal

Endowment

Canada

Renato Christ

Senior Insurance Investment Analyst

Farmers Insurance Group

Insurance

United States

Isla Chu

Director of Investments

Michigan State University

Endowment

United States

Marco De Leon

Associate Director – Real Estate Equity

Pacific Life Insurance

Insurance

United States

Daniel Demetrio

Investment Manager

Prudential

Private Pension

Brazil

Nicholas Devestine

VP – Investment Advisor Research

PNC Asset Management Group

Private Wealth

United States

Evelyn Drake

Director of Investments

Directors Guild of America – Producer Pension & Health Plans

Insurance / Private Pension

United States

Sophie Forest

Investment Officer

Bush Foundation

Foundation

United States

Matt Frass

Investment Analyst, Investment Services

Plannera Pensions & Benefits

Public Pension

Canada

Halie Gates

Senior Investment Analyst

GE Capital, North America Life and Health

Insurance

United States

Reese Gelley

Senior Investment Analyst

Teachers’ Retirement Allowances Fund

Public Pension

Canada

Mateo Goldman

Senior Vice President, Investments

US International Development Finance Corporation

Government Agency

United States

Harrison Griffin

Associate Portfolio Manager – Private Markets

Nova Scotia Pension Services Corp (NS Pension)

Public Pension

Canada

Arthur Grizzle

Manager – Investments & Trusts

Huntington Ingalls Industries (HII)

Private Pension

United States

Oscar Guardado

Senior Investment Analyst

Commonwealth Savers

Public Pension

United States

Kamen Hadjiivanov

Portfolio Manager

Wiener Städtische Versicherung – Vienna Insurance Group

Insurance

Vienna

Vicky Hall

Assistant Portfolio Manager – Alternatives

Border to Coast Pensions Partnership

Public Pension

United Kingdom

Fraser Harker

Associate Director, Investment Origination & Execution

Scottish Widows

Insurance

United Kingdom

Tuomo Hietaniemi

Senior Portfolio Manager, Alternative Investments

Ilmarinen

Insurance / Private Pension

Finland

Clint Huff

Senior Investment Officer

Texas Tech University System

Endowment

United States

Ben Hutchison

Analyst, Investments

Corewell Health

Pension / Insurance

United States

Rasmus Hvass Lang Pedersen

Portfolio Manager, Alternative Investments

PenSam

Private Pension

Denmark

Andrés Jablonski Arellano

Deputy CIO and Head of Strategy and Alternative Assets

AFC Chile

Insurance

Chile

Marcus Jia Lu Jiang

Senior Director, Fixed Income Portfolio Strategist

Sun Life

Insurance

China

Mads Julius Christensen

Portfolio Manager

TDC Pension Fund

Private Pension

Denmark

Herve Kamukuny

Analyst, Pension Fund

Hydro One

Private Pension

Canada

Armaan Kapoor

Senior Manager, Investments

Visa

Foundation

Singapore

Derek Kellman

Managing Director

Angeles Investments

OCIO

United States

Sarah Khouri

Vice President of Investments

VCU Investment Management Company (VCIMCO)

Endowment

United States

Brian Kowalski

Vice President of Investments and Assistant Treasurer

Thomas Jefferson University

Endowment

Misbah Lalani

Director & Senior Investment Analyst, Multi-Asset Solutions

Manulife Investment Management

Insurance

Canada

Andrew Leung

Manager III

Northrop Grumman Corporation

Private Pension

United States

Ramiro Ferrara López

Associate Fund Selector

MdF Family Partners

Family Office

Spain

Andreas Malle

Head of Alternatives and Private Capital

PBU Pension

Public Pension

Denmark

Zakariya Mansha

Performance Analyst

Universities Superannuation Scheme (USS)

Public Pension

United Kingdom

Christine Martin-Knezevic

Senior Investment Analyst

University of Nebraska Foundation

Foundation

United States

Andy May

Director, Private Equity Investments

Thrivent

Insurance

United States

Ryan McCauley

Sr. Analyst, Debt Market Strategies

New Mexico State Investment Council (SIC)

Sovereign Wealth Fund

United States

Blake McDonald

Director of Investments

Texas A&M Foundation

Foundation

United States

Henry McKenna

AVP, Investments

White Mountains Advisors

Insurance

United States

Michael Melluso

Investment Manager, Asset Allocation and Portfolio Optimisation

British International Investment

Government Agency

United Kingdom

Qaqamba Mgijima

Private Markets Analyst

Eskom Pension and Provident Fund

Private Pension

South Africa

Kate Mijakowska

Senior Investment Solutions Specialist

Brightwell Pensions

Private Pension

United Kingdom

Dragos Mosu

Portfolio Manager, Infrastructure Investments

Tecta Invest GmbH

Private Pension

Germany

Duc Nguyen

Senior Investment Analyst

Orange County Employees Retirement System (OCERS)

Public Pension

United States

Kevin O’Boyle

Investment Associate

University of Virginia Investment Management Company (UVIMCO)

Endowment

United States

James Overpeck

VP Investments

The Hanover Insurance Group

Insurance

United States

Arthur Paolucci

Investment Analyst

Fundação Real Grandeza

Foundation

Brazil

Raj Parikh

Senior Associate, Opportunistic Investments

Allstate Investments

Insurance

United States

Juha Parvianinen

Portfolio Manager

Keskinäinen Työeläkevakuutusyhtiö Elo

Private Pension

Finland

Jay Patrick

Senior Manager – Hedge Fund Investments

CVS Health

Private Pension / Insurance

United States

John Pearce

Portfolio Manager

Illinois Municipal Retirement Fund (IMRF)

Public Pension

United States

Reeves Pearce

Assistant CIO

Louisiana State Employees’ Retirement System

Public Pension

United States

Harry Huang Peng

Investment Analyst

GIC

Sovereign Wealth Fund

Singapore

Emma Radloff

Principal, Alternative Investments

OMERS

Public Pension

Canada

Matthieu Raoux

Portfolio Manager, Alternative Investments

NZ Super Fund

Sovereign Wealth Fund

New Zealand

Fattah Rinol

Investment Manager – UK & Ireland Pensions

Nestlé

Private Pension

United Kingdom

Bradley Rowbotham

Assistant Director, Private Markets

Novant Health

Private Pension

United States

Richard Rudner

Investment Manager

Emirates Investment Authority (EIA)

Sovereign Wealth Fund

United Arab Emirates

Omri Saadi

AVP – Alternatives

Aflac Global Investments

Insurance

United States

Tomoya Sato

Senior Associate

ORIX Life Investments (USA)

Insurance

Japan

Thomas Schultz

Principal Investment Analyst

Cornell University Investment Office

Endowment

United States

Andrew Schwert

Associate Investment Director

Boston University Endowment

Endowment

United States

Ben Sebers

Intermediate Portfolio Analyst

Aegon Asset Management

Insurance

United States

Nicholas Seney

Manager, Investment Management

Advance

OCIO

United States

Saad Shabbir

Vice President

Public Investment Fund (PIF)

Sovereign Wealth Fund

Saudi Arabia

Divyesh Shah

Senior Investment Officer

Dallas Police & Fire Pension System

Public Pension

United States

Ravi Shah

Senior Investment Analyst

The Mellon Foundation

Foundation

United States

Matthew Singer

Senior Investment Analyst

National Guardian Life Insurance Company (NGL)

Insurance

United States

Shiventa Sivanesan

Head of Investment Management & Stewardship

West Midlands Pension Fund

Public Pension

United Kingdom

Roberto Souza

Associate, Investments

Pragma

Multi Family Office

São Paulo

Santiago Tagle

Portfolio Manager

AFP Habitat (Chile)

Private Pension

Chile

Anthony Tang

Head of Public Markets

TTC Pension Plan

Public Pension

Canada

Yip Jee Theng

Head of Alternatives, Investment Research

Catalina Re

Insurance

United Kingdom

Amrita Tiwari

Investment Analytics

New York Life Insurance Company

Insurance

United States

Senior Investment Manager – Debt, Capital Markets & Alternatives

State Super (SAS Trustee Corporation)

Superannuation

Australia

James Turner

Senior Investment Manager, Private Credit & Private Equity

Nest Pensions

Private Pension

United Kingdom

Investment Manager – EMEA

Mars Pension

Private Pension

Netherlands

Investment Strategist – Alternative Investments

AFP Integra

Private Pension

Peru

Senior Investments Analyst

The Chicago Community Trust

Foundation

United States

Multi Family Office

United States

Khurram Wadhwani

Senior Investment Analyst, Private Markets

Texas Health Resources

Foundation

United States

Michael Watson

Director, Office of Investments

New York Presbyterian Hospital

Endowment

United States

Johnathan Weeast

Investment Analyst

New Jersey Division of Investment (DOI)

Public Pension

United States

Cole Weston

Director

Yale Investments Office

Endowment

United States

Investment Analyst

State of Michigan, Bureau of Investments

Public Pension

United States

Charith Witharanage

Senior Investment Analyst

Legalsuper

Superannuation

Australia

Craig Wocl

Deputy CIO

International Paper

Private Pension

United States

Lily Xu

Investment Analyst

Emory Endowment

Endowment

United States

Jay Jihoe Yoon

Investment Associate, Investments Team

Doris Duke Charitable Foundation

Foundation

United States

Euclidean

Foundation

United States

George Zhang

Investment Associate

Teacher Retirement System of Texas

Public Pension

United States

Catherine Zhang

Investment Officer

Contra Costa County Employees’ Retirement Association (CCCERA)

Public Pension

United States

Investment Officer, Private Equity

Teachers’ Retirement System of the State of Illinois

Public Pension

United States